Recently, the Blauberg China team held a seminar to discuss the application of fans in the energy storage market. The event aimed to share the vast prospects of the domestic energy storage market, propose a new approach for the application of Blauberg products, and explore and uncover more potential opportunities.

Since 2022, China has introduced a series of policies to actively support the development of the energy storage industry and promote the construction of a new power system. Among them, the “14th Five-Year Plan” for the development of new energy storage and fiscal support for carbon peak and carbon neutrality policies have become the core driving forces, with the ultimate goal focused on achieving the “dual carbon” targets.

According to CNESA statistics, China’s energy storage battery shipments reached 127.6 GWh in 2023, marking a staggering year-on-year increase of 170.8%. Among this, power storage accounted for 86% of the total (grid-side +172%, household storage +345%).

GGII, a high-tech industry research firm, forecasts that the global energy storage installation capacity will surpass 520 GWh (260 GW/520 GWh) by 2025, with China expected to contribute 240 GWh. The compound annual growth rate from 2023 to 2025 is expected to remain above 60%. This indicates that the energy storage market is far from saturated and is developing rapidly.

Blauberg products and energy storage products

At first glance, the energy storage industry products may seem unrelated to Blauberg Motoren products. However, upon closer examination, energy storage battery systems, energy storage inverters (PCS), combined inverter-boosters, and energy storage temperature control systems all require fans, where Blauberg fans play a crucial role.

Technological Trends: Lithium-ion Dominance and the Rise of Liquid Cooling.

Lithium-ion battery storage accounts for over 94%, maintaining its position as the market leader. Compressed air and flow batteries are growing rapidly and may emerge as dark horses in the future.

Innovation in temperature control technology: Liquid cooling, with its advantages of efficient heat dissipation, precise temperature control, and high space utilization, is gradually replacing air cooling systems. This is particularly evident in high-density, large-capacity energy storage scenarios, where it is accelerating penetration and driving industry energy efficiency upgrades.

Centralized energy storage has become the main force, and integrated systems are emerging as a “cost-cutting tool.”

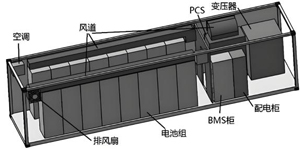

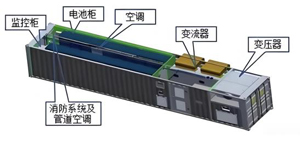

Centralized energy storage (containerized energy storage) serves as the core scenario, with key components including the battery system, inverter (PCS), and temperature control system.

The integrated inverter-boosting system combines the functions of inversion and voltage boosting. It is compact, highly efficient, and adaptable, simplifying system structure, reducing losses and costs, and supporting flexible deployment and intelligent control.

At the end of the session, the Sales Director made a conservative forecast: by 2026, China’s cumulative installed capacity for new energy storage will reach 48.5 GW (CAGR 53.3%); the ideal forecast predicts 79.5 GW (CAGR 69.2%). Industrial and commercial energy storage will drive demand for 380V/480V high-voltage fans, with liquid cooling growing far faster than air cooling!

With policy benefits and technological advancements, the energy storage industry has entered a golden period of development. From lithium-ion dominance to liquid cooling upgrades, from centralized energy storage to integrated inverters, every link in the industry chain holds opportunities.

Opportunities and challenges coexist, but Blauberg will not stop its progress. We look forward to the future!